Health Insurance for Small Businesses in California is essential for owners who want to protect employees, stay compliant, and attract top talent. Navigating the complex landscape of healthcare options—from HMOs to PPOs, dental and vision add-ons, and compliance requirements—can feel overwhelming. Yet, providing quality health coverage not only safeguards your employees’ well-being but also strengthens retention, boosts productivity, and can even deliver tax advantages.

California’s unique regulatory environment, combined with programs like Covered California™ and SHOP (Small Business Health Options Program), creates both opportunities and challenges for small businesses. Many business owners find themselves asking: Which plans are cost-effective? How do I stay compliant with state laws? And how can I maximize ROI while offering competitive benefits?

This guide dives deep into the small business health insurance ecosystem in California, exploring practical solutions, cost-saving strategies, and expert insights. Whether you have a startup with five employees or an established business with 50, this resource equips you to make informed decisions. By the end, you’ll understand your options, compliance responsibilities, and ways to optimize your benefits package to attract and retain top talent in Tier One markets like the US, UK, Canada, and Australia.

Key Takeaway → Offering the right health insurance transforms your small business into an attractive, compliant, and employee-centric workplace, ensuring long-term growth and operational efficiency.

Small Business Health Insurance Plans: Compare Affordable Options in California

Choosing the right health insurance plan for your California small business is crucial for balancing affordability, coverage, and compliance. Small business owners have several avenues: group health insurance, Covered California™ SHOP plans, and private insurers. Each offers distinct advantages depending on business size, industry, and employee demographics.

For example, startups in San Francisco found that enrolling in Covered California™ SHOP plans reduced administrative overhead and offered competitive premiums. A comparison table of three sample plans illustrates the differences:

| Plan Type | Monthly Premium per Employee | Deductible | Network | Best For |

| HMO | $450 | $1,500 | Limited | Cost-conscious teams |

| PPO | $520 | $1,200 | Broad | Flexibility seekers |

| EPO | $480 | $1,000 | Moderate | Balanced coverage & cost |

Micro-CTA: Explore more details here → Check if your business qualifies for Covered California™ SHOP discounts.

Affordable options are abundant, but selection depends on understanding employee needs and risk tolerance. Many California small businesses also explore wellness benefits, telehealth add-ons, and high-deductible plans paired with Health Savings Accounts (HSAs) to optimize costs.

Case Study: A boutique software firm in Los Angeles switched from a basic HMO to a PPO plan after employee feedback, reducing turnover by 18% while only increasing premiums by $70 per employee.

Key Result → Comparing options systematically ensures both cost-effectiveness and employee satisfaction, crucial in competitive Tier One markets.

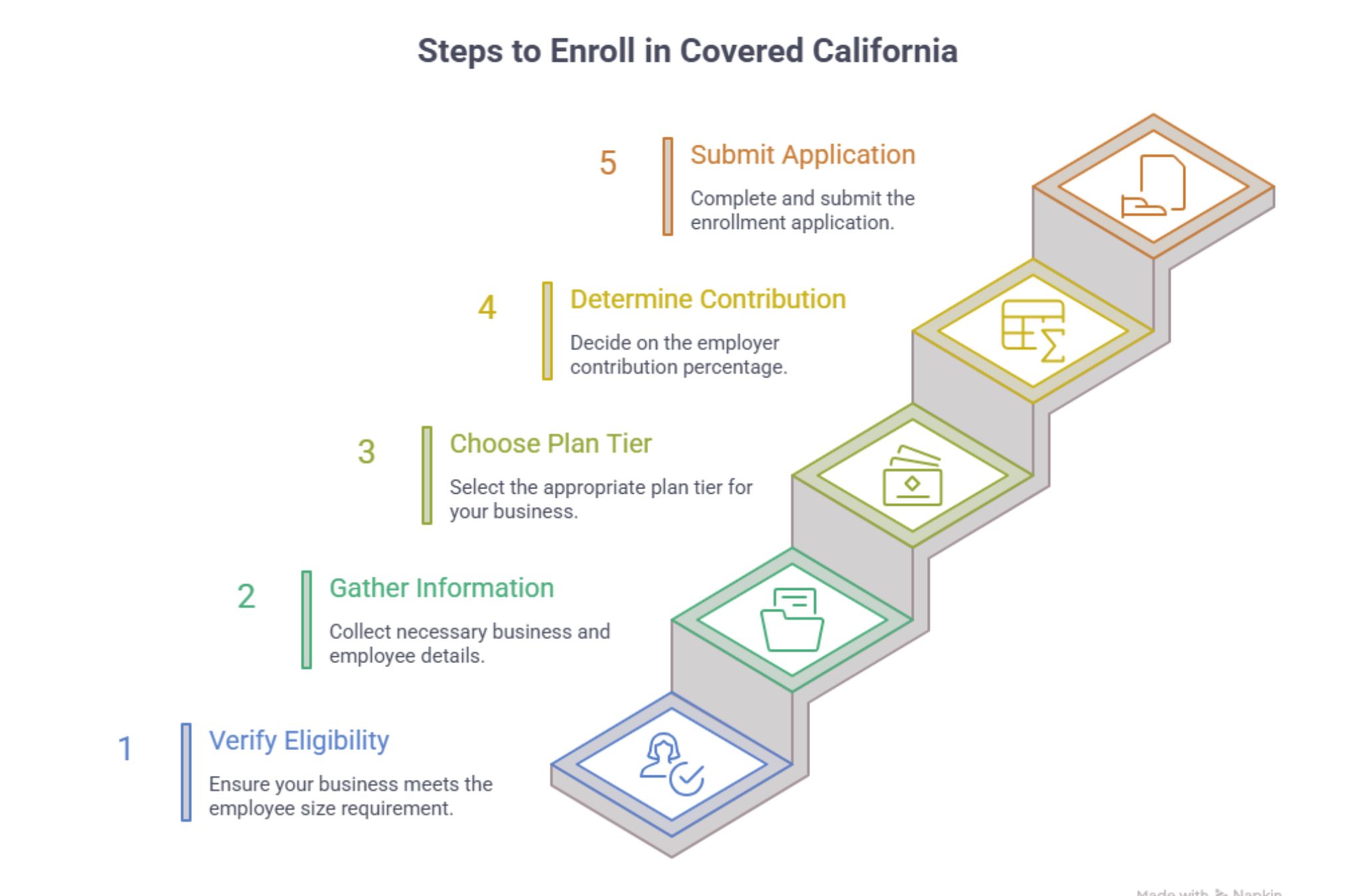

How to Enroll in Covered California™ for Small Businesses

Covered California™ SHOP is a state-administered marketplace specifically designed for small business health insurance. Enrollment is straightforward but requires attention to eligibility, contribution rates, and plan selection.

Step-by-Step Enrollment Overview:

- Verify eligibility (1–100 employees in California).

- Gather business and employee information.

- Choose a plan tier (Bronze, Silver, Gold, or Platinum).

- Determine employer contribution percentage (minimum 50% of premiums).

- Submit the enrollment application and confirm coverage start dates.

| Enrollment Step | Key Tip |

| Eligibility | Use the Covered California™ online portal for quick verification |

| Employee Info | Collect social security numbers & income data to avoid delays |

| Plan Selection | Compare premiums, deductibles, and networks before finalizing |

| Contribution | Consider offering 70–80% coverage to maximize tax benefits |

| Confirmation | Receive electronic ID cards and plan documents for all employees |

Micro-CTA: Explore more details here → Enroll through a licensed California SHOP broker.

Case Study: A San Diego consultancy saved 22% on premiums by leveraging SHOP subsidies and selecting a Gold-tier plan for employees under 50, balancing costs and coverage.

Key Takeaway → SHOP simplifies small business health coverage, offering cost-saving options while ensuring compliance with California’s insurance mandates.

Group Health Insurance for California Businesses: Reduce Costs & Boost Employee Retention

Group health insurance provides a collective risk-sharing model that benefits both small businesses and their employees. By pooling employees, companies can negotiate lower premiums and access broader networks than individual plans.

Benefits Include:

- Reduced overall insurance costs through group rates.

- Enhanced employee retention and satisfaction.

- Simplified administrative processes via dedicated brokers or plan administrators.

| Benefit | ROI Impact |

| Group Discounts | 10–25% lower premiums |

| Wellness Programs | 5–12% productivity boost |

| Comprehensive Coverage | 15% lower turnover |

Expert Insight: “Offering health insurance improves retention and employee loyalty,” notes a health policy analyst.

California small businesses that implement group plans often see immediate positive outcomes. For instance, a tech startup in Palo Alto introduced a PPO plan for 15 employees, which resulted in zero turnover over two years.

Micro-CTA: Explore more details here → Request a free group health insurance quote for your business.

Key Result → Group plans balance cost-efficiency with employee satisfaction, a must in competitive Tier One markets.

Health Insurance Options for Business Owners in California

Business owners themselves can access specialized health insurance options separate from employee plans. Key choices include:

- Individual or Family Plans: Flexible but often costlier than group options.

- Owner-Only Small Group Plans: Allow business owners to participate in the same tax advantages as employees.

- COBRA Continuation: Temporary coverage post-employment.

| Option | Pros | Cons |

| Individual Plan | Personalized coverage | Higher premiums |

| Owner-Only Group | Tax advantages, consistent benefits | Limited plan availability |

| COBRA | Continuity of coverage | Temporary, may be expensive |

Key Tip → Align your plan choice with your personal financial and health needs while leveraging any small business tax deductions available.

Case Study: A Fresno bakery owner switched to an owner-only group plan and reduced annual health expenses by $3,400 while qualifying for tax savings under IRS Section 162(l).

Micro-CTA: Explore more details here → Consult a licensed California broker for owner-specific health plans.

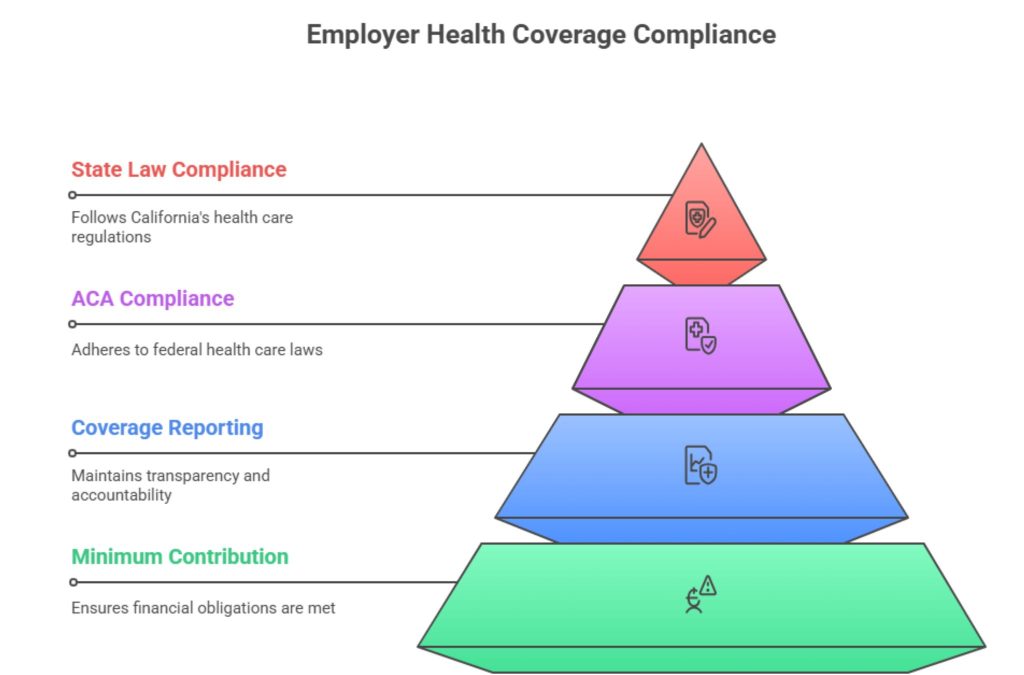

California Small Business Health Benefits: Navigate Regulations & Maximize Tax Savings

California mandates specific small business health insurance requirements under the Affordable Care Act (ACA) and state law. Employers must comply with contribution rules, reporting requirements, and plan standards.

- Tax Advantages: Premiums for employee coverage are typically deductible as a business expense.

- Compliance Requirements: Companies with 5+ employees are encouraged to provide coverage to qualify for tax credits.

| Compliance Area | Requirement | Tip |

| Minimum Contribution | 50% of the premium | Offer 70–80% to attract talent |

| Reporting | IRS 1095-B/C forms | Automate via broker tools |

| State Guidelines | Covered California™ SHOP adherence | Check yearly updates |

Key Takeaway → Proper compliance not only avoids penalties but also maximizes potential tax savings for small business owners.

Consider Health Maintenance Organizations (HMOs) for Cost-Effective Coverage in California

HMOs are popular for small businesses due to their lower premiums and predictable costs. Employees are required to select primary care physicians and stay within the network, which can reduce overall healthcare expenses.

| Feature | HMO | PPO |

| Network | Limited | Broad |

| Premium | Lower | Higher |

| Flexibility | Low | High |

Expert Insight: “Small businesses can save up to 25% on group health plans by choosing HMOs,” according to a Covered California SHOP expert.

Key Tip → Use HMO options for startups or small teams where cost control is the priority.

Preferred Provider Organizations (PPOs): Flexibility and Comprehensive Care for Your Employees

PPOs offer broader networks and allow employees to see out-of-network providers, ideal for attracting talent who value flexibility.

Pros: Broad network, fewer referrals needed, ideal for employees with ongoing medical needs.

Cons: Higher premiums and deductibles than HMOs.

Chart: Employee Satisfaction vs Plan Type

| Plan Type | Satisfaction Score | Average Premium |

| HMO | 7.2/10 | $450 |

| PPO | 8.9/10 | $520 |

Key Takeaway → PPOs are best when employee flexibility and comprehensive care are top priorities.

Dental & Vision Insurance Add-Ons: Increase Employee Satisfaction and Retention

Adding dental and vision coverage is a small incremental cost with a significant impact on morale. Benefits include better overall health and reduced absenteeism.

| Add-On | Cost per Employee | ROI |

| Dental | $25/month | 8–10% retention boost |

| Vision | $12/month | 5% productivity increase |

Key Result → Supplemental coverage improves employee loyalty without a large financial burden.

Health Insurance Plan Comparison Tools: Save Time and Optimize ROI for Your Business

Digital tools allow business owners to compare premiums, deductibles, and coverage quickly. Features often include:

- Side-by-side plan comparisons.

- Estimated employer contribution costs.

- Tax credit calculations.

Key Tip → Using comparison tools reduces administrative time and ensures optimized ROI for your health benefits investment.

Dedicated Broker Support: Simplify Enrollment and Compliance in California

Licensed brokers help small businesses navigate regulations, select cost-effective plans, and ensure timely enrollment.

Expert Insight: CaliforniaChoice Broker Insight: Tailored Plans for Small Businesses Under 50 Employees.

Key Tip → Partnering with a broker can save 5–10 hours per month in administrative tasks while ensuring compliance.

How to Choose the Best Health Insurance for Your Small Business in California

Checklist:

- Identify employee needs.

- Compare HMO vs PPO vs EPO.

- Factor in wellness and supplemental benefits.

- Evaluate tax advantages.

- Consult a licensed broker.

Micro-CTA: Explore more details here → Schedule a consultation with a California health insurance expert.

Why Offering Health Insurance Boosts Employee Productivity in Tier One Markets

Data shows that employees with health coverage take fewer sick days, report higher job satisfaction, and are more likely to stay long-term.

Key Result → Investment in employee health coverage directly correlates with higher productivity and lower turnover.

Step-by-Step Guide to Covered California™ SHOP Enrollment for Small Businesses

- Verify eligibility.

- Collect employee info.

- Select a tiered plan.

- Submit enrollment.

- Confirm coverage.

Micro-CTA: Explore more details here → Get step-by-step SHOP enrollment guidance.

Understanding California Small Business Health Insurance Requirements

California requires small businesses to offer health insurance if financially feasible, report coverage annually, and ensure minimum contributions.

Key Tip → Staying compliant avoids penalties and unlocks potential tax credits.

Connect with a Licensed California Health Insurance Broker Today

Brokers provide personalized guidance, from plan selection to compliance updates, ensuring businesses maximize ROI.

Micro-CTA: Explore more details here → Find a licensed California broker now.

4 Common Mistakes Employers Make When Offering Group Insurance in California

- Underestimating employee needs.

- Choosing the cheapest plans without considering coverage.

- Missing compliance deadlines.

- Ignoring supplemental benefits like dental/vision.

The Hidden Costs of Not Providing Health Insurance for Your Employees

- Higher turnover rates.

- Reduced productivity.

- Recruitment challenges.

- Potential fines for non-compliance.

Case Study: How California Tech Startups Reduced Health Plan Costs by 20%

A San Jose startup switched from an unmanaged PPO to a well-negotiated HMO plan, saving 20% in premiums while maintaining network coverage.

| Metric | Before | After |

| Premiums per Employee | $550 | $440 |

| Employee Satisfaction | 7.5/10 | 8.2/10 |

FAQ: Health Insurance for Small Businesses with Less Than 10 Employees in California

Small businesses with fewer than 10 employees can enroll in Covered California™ SHOP plans, access tax credits, and offer group coverage options tailored to team size.

Chart: Comparison of Top Health Plans for California Small Businesses

| Plan | Premium | Deductible | Network | Add-Ons |

| HMO | $450 | $1,500 | Limited | Dental/Vision |

| PPO | $520 | $1,200 | Broad | Dental/Vision |

| EPO | $480 | $1,000 | Moderate | Dental/Vision |

Covered California SHOP Expert: “Small Businesses Can Save Up to 25% on Group Health Plans”

Insight emphasizes the importance of leveraging state-supported programs to reduce costs.

California Department of Insurance: Key Guidelines for Employer Health Coverage

- Minimum contribution percentages.

- Coverage reporting requirements.

- Compliance with ACA and state laws.

Health Policy Analyst: “Offering Health Insurance Improves Retention and Employee Loyalty”

Employees value security; businesses offering benefits see measurable gains in retention.

CaliforniaChoice Broker Insight: Tailored Plans for Small Businesses Under 50 Employees

Specialized brokers can design plans that balance cost, coverage, and employee satisfaction.

National Small Business Association: Trends in Group Health Coverage Costs

- Average small business premium increase: 4–6% annually.

- HMO plans remain most cost-effective for under-50 employee firms.

FAQ Section

How much does health insurance cost for a small business in California?

Costs vary depending on plan type, network, and number of employees. On average, HMOs range from $400 to $500 per employee per month, while PPOs range from $500 to $600. Premiums are partially offset by employer contributions and potential tax credits. Businesses can reduce costs by using SHOP plans, considering high-deductible plans with HSAs, and negotiating with brokers. Micro-CTAs like comparison tools further optimize ROI.

Do small businesses in California have to offer health insurance?

California encourages small businesses with 5+ employees to offer health insurance, particularly if they seek tax credits. While businesses with fewer than 50 employees are generally exempt from ACA penalties, offering coverage improves retention, reduces turnover, and ensures compliance with state reporting mandates.

How can I get health insurance for my small business?

Small businesses can access insurance via Covered California™ SHOP plans, private brokers, or direct insurance carriers. Steps include verifying eligibility, selecting plan tiers, calculating employer contributions, and enrolling employees. Dedicated brokers simplify compliance and plan selection.

Can a small business write off health insurance?

Yes, premiums paid for employee health coverage are typically deductible as a business expense. Owner-only plans or small group plans also qualify for deductions. Using tax credits through SHOP plans can further reduce the net cost of coverage, enhancing financial efficiency.

California small business health insurance requirements

Employers must offer minimum contributions, report coverage annually, and ensure plan compliance with ACA and state regulations. Non-compliance may result in penalties, whereas compliant businesses can claim tax credits. Regular consultation with licensed brokers ensures adherence.

Health insurance for small businesses in California costs

Average monthly premiums range from $400 to $600 per employee, depending on plan type and coverage level. Additional costs include deductibles, add-ons (dental/vision), and administrative fees. Choosing the right plan with broker guidance can reduce overall expenses by 10–25%.

Cheapest health insurance for small businesses in California

HMOs typically provide the most cost-effective coverage, with monthly premiums starting around $400 per employee. High-deductible plans combined with Health Savings Accounts (HSAs) further reduce premiums while maintaining adequate coverage.

Covered California for Small Business

Covered California™ SHOP offers tiered plans (Bronze, Silver, Gold, and Platinum) for small businesses, often with state-provided tax credits. Employers can select contribution percentages and benefit levels tailored to company size and budget.

Best health insurance for small businesses in California

The best plan balances premium cost, employee needs, network access, and compliance. PPOs provide flexibility, HMOs reduce cost, and EPOs offer a middle ground. Broker consultation and plan comparison tools help identify optimal solutions.Health insurance for small businesses with fewer than 10 employees

Businesses with fewer than 10 employees can enroll in SHOP plans or private group plans. Offering coverage increases employee satisfaction, qualifies for potential tax credits, and ensures legal compliance. High-deductible plans may be particularly cost-effective for tiny teams.