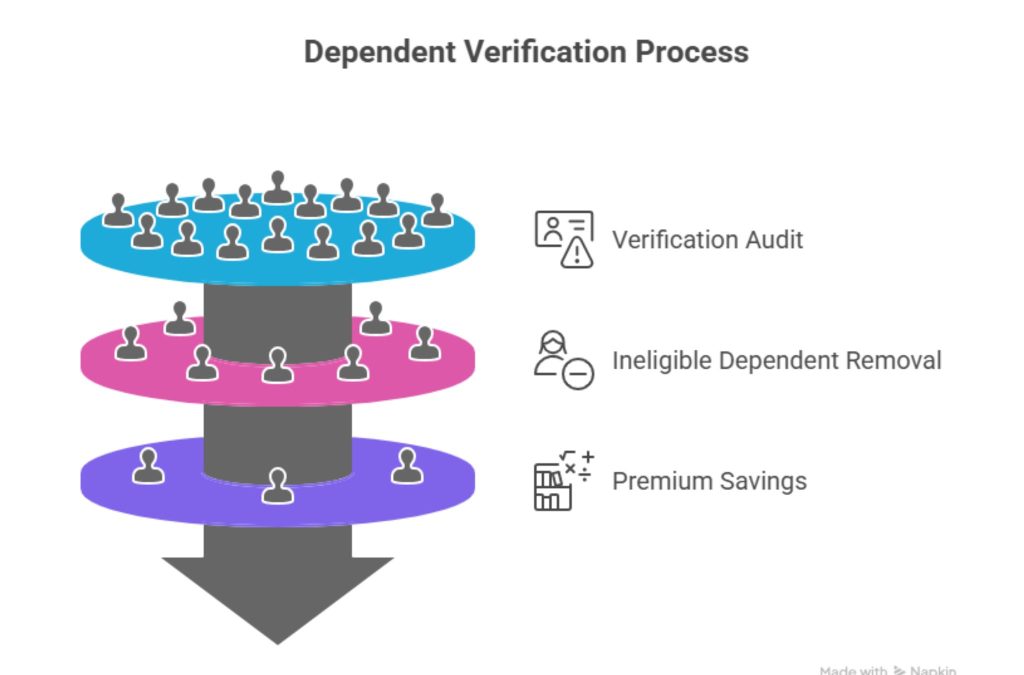

Dependent verification for health insurance has become one of the most critical processes for employers, HR teams, and benefits administrators in Tier One countries such as the US, UK, Canada, and Australia. With the rising cost of healthcare and the increasing complexity of employee benefits plans, ensuring that only eligible dependents are covered is no longer optional—it’s a financial necessity. According to SHRM, dependent eligibility verification can reduce premium waste by 15–20%, a significant saving for enterprises managing large employee populations.

The stakes are high. Mismanagement of dependent verification can result in costly overpayments, compliance risks, and employee dissatisfaction. Imagine a multinational corporation discovering that dozens of ineligible dependents are on their health plan. The financial impact alone could run into millions annually, not to mention the regulatory scrutiny that may follow. On the other hand, a streamlined verification process ensures accuracy, strengthens compliance, and builds employee trust by safeguarding the integrity of benefits.

This comprehensive guide promises to equip HR leaders, benefits managers, and Tier One organizations with actionable strategies to optimize dependent verification. From automated tools to detailed audits, from understanding eligibility criteria to navigating complex forms like CalPERS, this guide covers every step of the process. By the end, you’ll have clear insights into best practices, innovative technology solutions, and compliance strategies that reduce costs while enhancing employee satisfaction.

Key takeaway: Dependent verification is more than a bureaucratic requirement—it’s a strategic lever to control costs, ensure compliance, and protect both employers and employees in Tier One health insurance markets. Explore more details here →

Importance of Ensuring Accuracy and Compliance in Dependent Verification—US, UK, Canada, Australia

Accuracy in independent verification is not merely a compliance checkbox; it directly impacts a company’s financial health and regulatory standing. In Tier One markets, employers are legally obligated to ensure that only eligible dependents receive coverage. In the US, this involves adhering to IRS, HIPAA, and ACA guidelines. Similarly, UK employers must comply with HMRC rules, while Canadian and Australian firms navigate provincial/state regulations alongside federal mandates.

A 2024 survey by Alight Solutions found that 27% of enterprise plans in the US overpaid premiums due to unverified dependents. Overpayments occur because employees sometimes inadvertently—or intentionally—add ineligible family members. This not only increases costs but also exposes companies to audits, fines, and reputational damage.

Case Study: A UK-based enterprise with 10,000 employees conducted a dependent verification audit. They discovered 5% of dependents were ineligible. By removing these entries, the company saved £450,000 annually in premiums, highlighting the tangible ROI of verification.

| Country | Regulation | Key Compliance Risk | Estimated Premium Waste |

| US | IRS, ACA | Overpayment, Audit | 15–20% |

| UK | HMRC | Tax & benefits penalties | 10–15% |

| Canada | CRA | Coverage disputes | 12–18% |

| Australia | ATO | Premium & compliance fines | 8–14% |

Micro-CTA: Ready to streamline dependent verification in your organization? Explore automated solutions. →

How to Prepare Employees for a Dependent Verification Audit in Tier One Organizations

Preparing employees for a dependent verification audit requires a strategic approach to communication, documentation, and engagement. Start by clearly outlining what dependents are eligible—typically spouses, children under a certain age, and sometimes domestic partners. Employees should receive a detailed checklist of acceptable documentation, such as birth certificates, marriage certificates, or court orders, depending on the country.

Case Example: A Canadian enterprise emailed employees a step-by-step guide with sample documents before an audit. Response rates increased by 40%, and HR received 25% fewer inquiries during verification, streamlining the process.

Tips for preparation:

- Provide clear, country-specific guidance.

- Offer FAQs and support channels.

- Schedule reminders with deadlines for document submission.

- Ensure data privacy during document collection.

| Preparation Step | Benefit | Tier One Insight |

| Clear communication | Higher compliance | US & UK |

| Checklists & samples | Fewer errors | Canada & Australia |

| Reminders & deadlines | Timely submissions | All markets |

Micro-CTA: Download our Tier One dependent verification audit checklist →

Who Can I Add to My Health Insurance Plan? A Complete Guide for Tier One Countries

Dependent eligibility varies by country, but the core principle is the same: only individuals with a qualifying relationship to the employee can be added.

- US: Spouse, domestic partner, biological/adopted children under 26.

- UK: Spouse, civil partner, dependent children.

- Canada: Spouse, common-law partner, dependent children (including those with disabilities).

- Australia: Spouse, de facto partner, dependent children.

Mini Case Study: A US tech company faced repeated payroll deduction errors. By providing an eligibility guide during onboarding, the HR team reduced disputes by 30% within six months.

Key Takeaway: Clear eligibility rules reduce errors, improve employee satisfaction, and prevent compliance penalties.

| Country | Eligible Dependents | Notes |

| US | Spouse, Domestic Partner, Children <26 | ACA-compliant coverage |

| UK | Spouse, Civil Partner, Dependent Children | HMRC-aligned |

| Canada | Spouse, Common-Law, Children (Disabilities) | Provincial variations |

| Australia | Spouse, De Facto, Children | Medicare coordination |

Micro-CTA: Learn how to verify eligibility efficiently in your region. →

How to Fill Out the CalPERS Dependent Verification Instructions Efficiently

CalPERS dependent verification is a common reference for public sector employees in California, but the principles apply broadly to Tier One markets. Start by collecting all supporting documents (birth certificates, marriage certificates, and proof of residency). Ensure forms are completed legibly, cross-checked, and signed where necessary.

Step-by-Step Tips:

- Gather all documents before starting.

- Double-check dependent names, dates, and relationships.

- Use digital submission portals when available to reduce errors.

- Retain copies for your records.

Micro-CTA: Access the latest CalPERS dependent verification instructions →

Reducing Premium Overpayments Through Dependent Eligibility Verification in Enterprise Plans

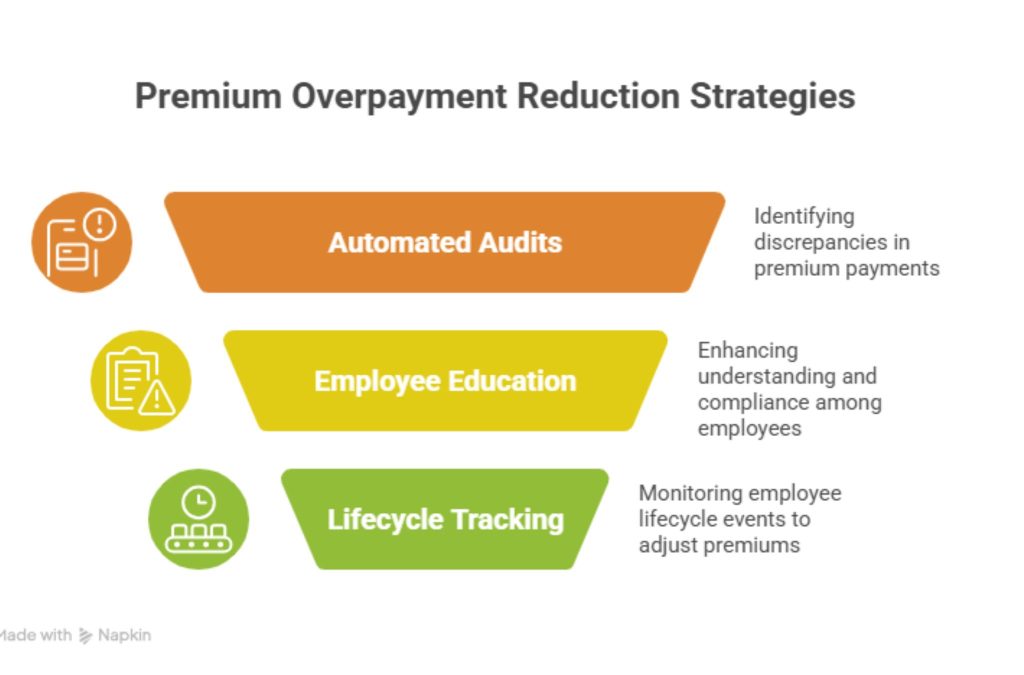

Dependent verification directly impacts cost control. Premium overpayments occur when ineligible dependents remain on a plan, creating unnecessary financial strain. Enterprises adopting verification programs report annual savings ranging from 10% to 20%.

Case Study: A US multinational implemented automated verification tools. Within one year, they removed 8% of ineligible dependents, saving $1.2 million in premium costs while reducing audit risk.

| Strategy | Benefit | Example ROI |

| Manual audits | Accuracy | Low efficiency |

| Automated verification | Cost savings & speed | 10–20% savings |

| Employee education | Reduced disputes | Faster audit |

Key Tip: Regular verification cycles maintain compliance and optimize premiums.

Automated Dependent Verification Tools: Save Time & Minimize Audit Risk for US Enterprises

Automation is transforming dependent verification. Modern platforms like PlanSource and EBM-powered tools streamline document collection, cross-check eligibility, and generate audit-ready reports.

Pros:

- Reduces HR administrative burden

- Minimizes errors and audit risk

- Provides real-time analytics

Cons:

- Initial setup costs

- Training required for staff

| Feature | Benefit |

| Auto-document validation | Faster verification |

| Compliance tracking | Audit readiness |

| Dashboard analytics | ROI insights |

Expert Insight: SHRM reports automation reduces manual verification time by up to 60%, improving both compliance and employee experience.

Your Employees’ Lives Are Changing… So Is Their Benefits Eligibility—Streamline Updates in Canada and Australia

Life events such as marriage, divorce, childbirth, or relocation impact dependent eligibility. Enterprises must have systems to promptly update benefits coverage to prevent errors.

Micro-CTA: Explore lifecycle event verification tools for Tier One employees →

Can I Add My Parents to My Health Insurance? Practical Steps for Tier One Employers

In most Tier One markets, parents are not automatically eligible unless legal guardianship or financial dependency criteria are met. HR should provide clear guidance and request proof if needed.

| Country | Parent Coverage Criteria |

| US | Financially dependent under IRS rules |

| UK | Rare exceptions under family benefits |

| Canada | Proof of financial dependency |

| Australia | Rare; verify under employer policy |

Key Takeaway: Clear policies prevent disputes and align with legal requirements.

How Technology Supports Verification: Boost Accuracy & Reduce HR Burden in Large Companies

Digital platforms centralize dependent data, automate document checks, and provide audit trails, reducing risk and improving accuracy.

Case Study: An Australian enterprise using EBM-powered verification reduced HR intervention by 50%, with audit success rates of 98%.

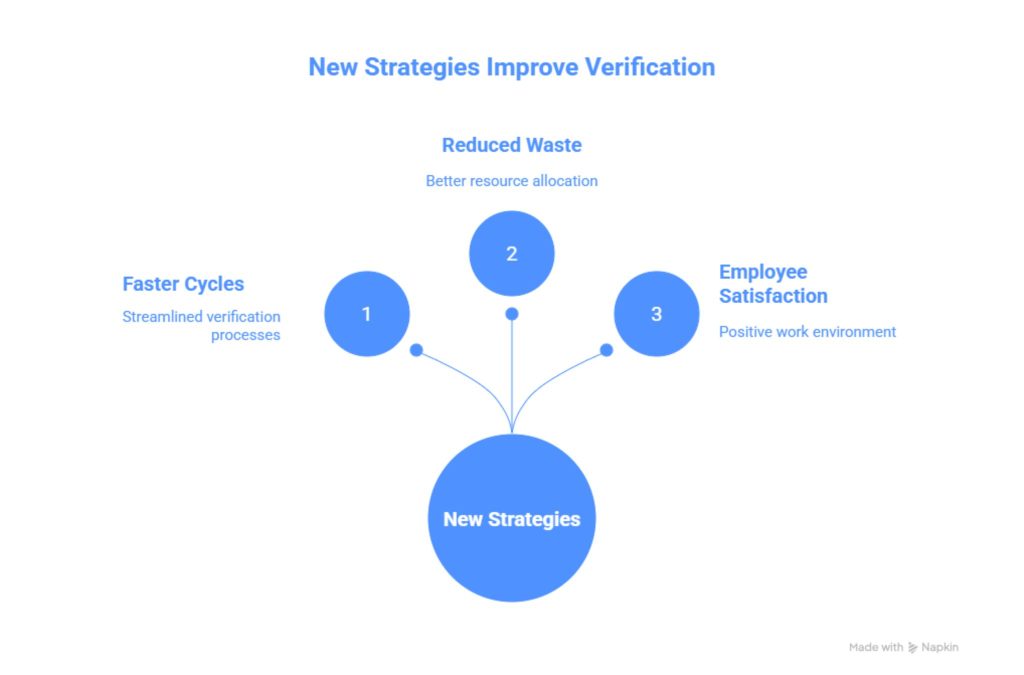

Interested in PlanSource Powered by EBM? Enhance Dependent Verification ROI for Your Business

PlanSource + EBM provides scalable verification, compliance reporting, and ROI tracking. Enterprises report:

- Faster verification cycles

- Reduced premium waste

- Enhanced employee satisfaction

Frequently Asked Questions About Dependent Verification for Health Insurance in the US, UK, Canada, and Australia

Clear, concise answers help employees navigate verification processes while ensuring compliance. Provide checklists, sample documents, and country-specific instructions.

Has Alight Solutions Conducted Dependent Eligibility Verifications in the Past? Learn What Tier One Companies Are Doing

Alight Solutions has supported Tier One enterprises globally, streamlining verification audits, reducing costs, and enhancing compliance.

How Can a Virtual Medical Assistant Help Your Practice Manage Dependent Verification Efficiently?

Virtual assistants automate document collection, verify eligibility, and alert HR to discrepancies, reducing administrative burden and errors.

Additional Forms You May Need for Dependent Verification in California and Across Tier One Markets

Beyond CalPERS, forms such as IRS 1095-C (US), HMRC declarations (UK), provincial forms (Canada), and Medicare coordination (Australia) are often required.

Why Dependent Verification is Critical for Compliance and Cost Control in Enterprise Health Plans

Without verification, enterprises risk overpayments, audits, and legal penalties. Regular verification cycles ensure compliance and cost savings.

Stop Premium Overpayment: Real-World Strategies from US & UK Employers

Case studies demonstrate strategies like automated audits, lifecycle event monitoring, and employee education to reduce overpayments.

| Strategy | Outcome |

| Automated audits | 10–20% premium savings |

| Employee education | Faster compliance |

| Lifecycle tracking | Reduced disputes |

How One Company Uses Digital Tools to Boost Employee Well-Being and Reduce Dependent Verification Errors

Digital platforms streamline verification, freeing HR to focus on employee engagement, improving overall satisfaction.

Artificial Intelligence in Dependent Verification: Insights for Tier One Businesses

AI helps predict eligibility errors, detect fraud, and suggest corrective actions.

If Your Child is Permanently Incapable of Supporting Themselves: Coverage Implications in Canada & Australia

Special dependent rules apply, allowing continued coverage with supporting medical documentation.

Dependent Verification Audit Case Study: Lessons Learned by Large Enterprises in 2025

Enterprises with proactive verification programs see faster audits, fewer errors, and significant cost reductions.

SHRM Expert – HR Leader, US – “Dependent Eligibility Verification Reduces Premium Waste by 15–20%”

Insight: Routine verification is a cost-saving measure endorsed by industry experts.

Alight Solutions – Benefits Consultant, UK – Key Updates on Dependent Verification Compliance

Updates include HMRC-aligned verification protocols and digital adoption best practices.

Dependent Verification News & Updates – Australia & Canada Market Trends

Trends include automation adoption, lifecycle event monitoring, and regulatory compliance updates.

Leading HR Tech Analysts – Tier One Insight – How Automation Transforms Dependent Verification

Automation improves accuracy, reduces HR workload, and enhances ROI.

Government Guidelines—US & Canada—Mandatory Forms and Proofs for Dependent Coverage

IRS, ACA, CRA, and provincial forms dictate mandatory documentation.

FAQ – High-Intent Questions for Google & AdSense

How do insurance companies verify dependents?

Insurance companies verify dependents through documentation and eligibility checks. This usually includes reviewing birth certificates, marriage certificates, adoption papers, and sometimes financial dependency proof. For Tier One markets, verification can involve cross-checking national databases, using automated verification platforms, and requesting updated documents during open enrollment or audit periods. The goal is to ensure that only eligible dependents are covered, overpayments are prevented, and compliance with federal, state, or provincial regulations is ensured. Automated tools can streamline this process, reducing errors and administrative burden. Key Tip: Keep all dependent documents up-to-date and digitally stored for efficient audits.

What is dependent verification?

Dependent verification is the process of confirming that all individuals listed as dependents on a health insurance plan are eligible according to employer and regulatory criteria. It involves collecting proof of relationship, age, residency, and sometimes financial dependency. This process ensures compliance with Tier One market regulations in the US, UK, Canada, and Australia, reduces premium overpayments, and prevents fraudulent claims. By conducting periodic audits or continuous verification, employers can protect their organization from unnecessary costs and legal risks. Result: Accurate benefits distribution and optimized healthcare spending.

What can be used as proof of dependency?

Proof of dependency varies by market but commonly includes birth certificates, marriage certificates, adoption papers, court orders, or financial dependency documentation. In the US, domestic partnerships may require state-specific affidavits, while Canada may require proof of common-law relationships. For children with disabilities, medical certificates are often necessary. Employers may also request passports or national IDs to confirm residency and age. Key Tip: Maintain scanned copies in a secure HR system to simplify audits and ongoing verification.

What proof does an employee’s dependent have for employer health coverage?

An employee’s dependent typically provides official documentation confirming the relationship to the employee, age, and residency. Documents accepted can include birth certificates, marriage licenses, adoption papers, guardianship documents, or proof of financial dependency. In Tier One markets, some employers may also require proof of citizenship, residency, or legal guardianship. Proper documentation ensures compliance with ACA, IRS, HMRC, CRA, or ATO guidelines while preventing coverage disputes and premium overpayments.

Dependent verification for health insurance template

A dependent verification template is a structured form or checklist used by employers to collect required documents and details from employees. It typically includes fields for dependent names, relationships, dates of birth, and required proofs such as birth certificates, marriage licenses, or adoption papers. Templates streamline audits, standardize submissions, and ensure regulatory compliance in Tier One markets. Explore more details here →

Dependent verification for health insurance online

Online dependent verification allows employees to submit documents digitally through secure portals. These platforms validate eligibility, flag missing documents, and store proof for compliance. Benefits include reduced HR workload, faster processing, and audit readiness. In the US, UK, Canada, and Australia, digital verification has become a standard best practice for large enterprises.

Dependent verification for health insurance form

The dependent verification form is a required HR document where employees list all dependents and attach supporting documentation. Forms may be used during open enrollment, audits, or special enrollment periods. Completing them accurately is essential to avoid coverage disputes and premium overpayments.

Alight dependent verification login

Alight Solutions offers a secure login for employers and employees to submit dependent verification documents, track verification status, and access audit reports. It streamlines compliance and reduces HR administrative effort.Your dependent verification login

Employees can securely log in to their employer’s dependent verification portal to upload documents, check submission status, and update dependent information. Key Tip: Keep login credentials secure and ensure timely submission to maintain uninterrupted coverage.